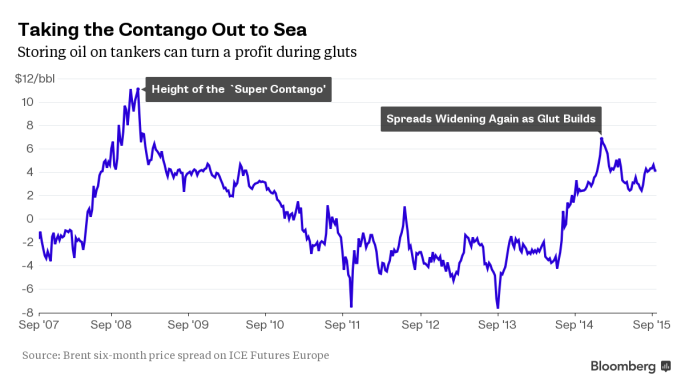

As you can see, this is not the first time the US has used tankers at sea to store oil in hopes of higher prices. As a matter of fact, in 2008 the level was much higher. But, we’re not done with this market, yet. We could be headed for those levels and beyond if things keep up as they are.

Here is an excerpt from this article:

The profit opportunity requires a little further steepening of the Brent forward curve at current freight rates, Goldman said in a Sept. 11 report. The widening spread is bringing the potential of floating storage “back into play,” Citigroup said this month.

The spread would need to widen to $4 a barrel during a three-month period for storage to be viable, according to estimates by E.A. Gibson Shipbrokers Ltd. on Sept. 23. Brent crude for November settlement was at a $2.08 discount to the February contract on the London-based ICE Futures Europe exchange at 11:52 a.m. in Hong Kong.

“Once Iranian crude is out in the market, then it might start affecting spot prices for crude oil, which could eventually open up the contango again,” Nikhil Jain, an analyst at Drewry Shipping in New Delhi, said by phone. The spread during a three-month period needs to reach about $3.30 a barrel before floating storage would work, he said.